Sample of our Retirement Plan & Deliverables

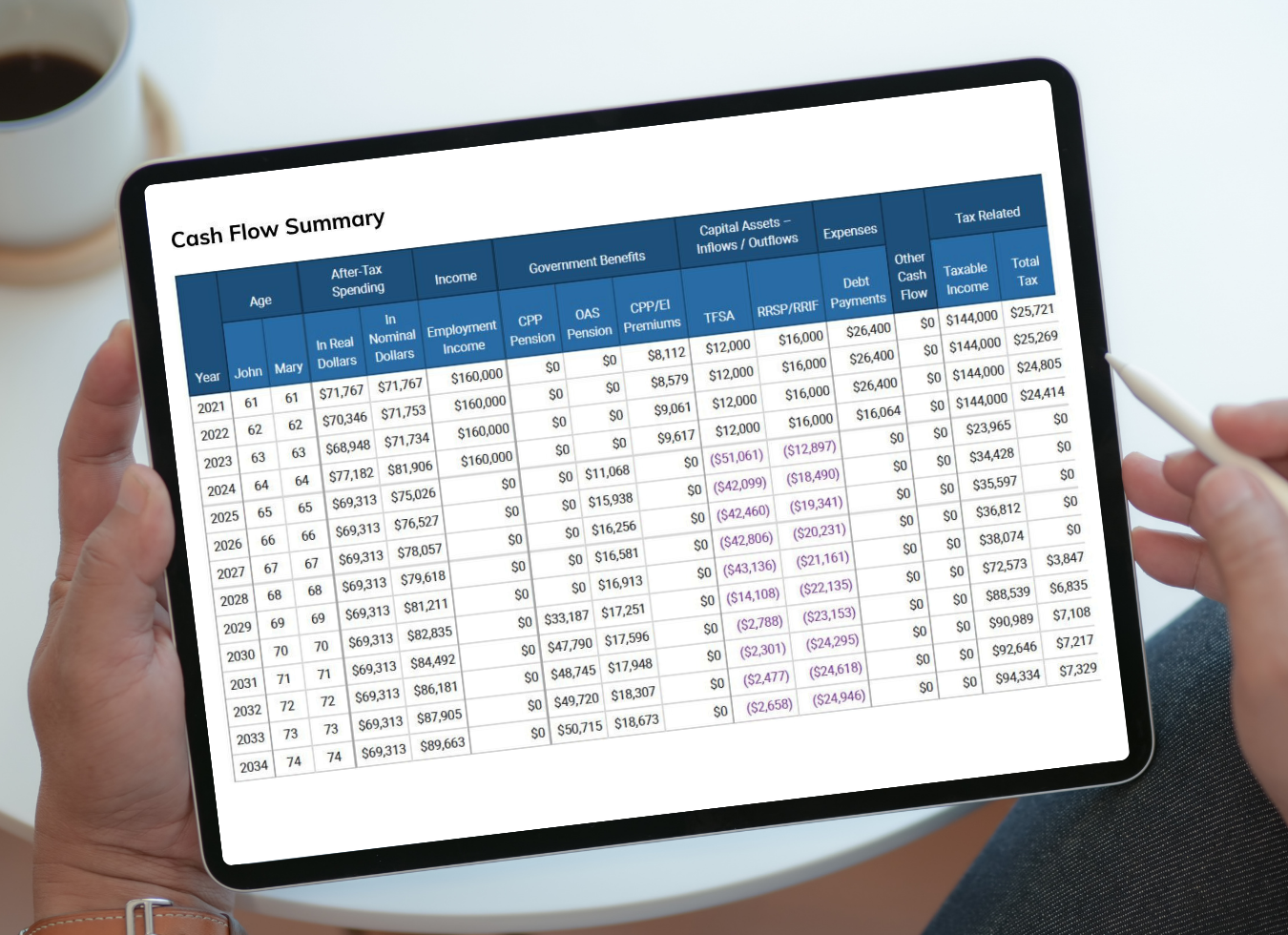

Our Retirement Plans are built on a dynamic program that we walk through with you in detail. We ensure you fully understand every aspect of your plan, from income flow to taxes, estate planning, and more. We work with you to clarify each piece, ensuring you feel confident about your financial future.

The deliverables we provide include a detailed Retirement Guide, both a PDF and Excel version of your plan, and a video that breaks down your plan PDF so you can easily understand how to navigate and interpret the report.

Frequently Asked Questions

How do I get started?

Which plan is best for me?

Why work with Parallel Wealth?

Fee-For-Service Planning Process

Retirement Income Program™

Need support with the implementation of your retirement plan? Check out our Retirement Income Program™

Parallel Wealth looks after the Ongoing Retirement Planning and our partnered Portfolio Management firm manages your assets.

By each staying in our own lane, our clients get two professional firms to support them and their needs through retirement. Parallel Wealth quarterbacks the process and ensures your plan and assets are aligned.

Do You Have Enough to Retire?

Knowing whether you have enough to retire is the number one concern for most Canadians approaching retirement. It's the first step in the planning process. We'll help determine if you have enough saved and identify the ideal time to retire, whether that's now or a few years down the road. Once that's clear, we move to the next step: figuring out how to draw income in the most efficient way.

How Will You Fund Retirement?

Imagine having a clear picture of where your retirement income will come from, how much you’ll receive, and the best time to start each income stream such as your RRIF, CPP, OAS, and more. Our plans break it down in simple, easy-to-understand language, so you’ll have full confidence in your retirement strategy.

Is Your Plan Stress-Tested?

Death of a spouse, market crashes, high inflation, helping out kids and grand kids – life can take unexpected turns. We all have different fears when it comes to our finances. Our plans help you visualize the impact of the scenarios that keep you up at night, so you can face your financial worries head-on and enjoy a worry-free retirement.

Looking to Pay Less Tax?

Our retirement plans are designed to keep your hard-earned money where it belongs – in your pocket, not with the CRA. Our Parallel Wealth retirement plans will help you minimize tax liabilities throughout retirement and on your estate.